Setup and configuration

Define default settings for the reservation process and no. series.

3 minute read

Being a non-profit, a charity or any other fund-based organization means that you rely on external financial resources whose terms and conditions can vary depending on their source or characteristics.

On the one hand, your funding can be unpredictable and may not always be sufficient for accomplishing your mission. On the other hand, because of the nature of your organization, regular reporting is a sine qua non for receiving funds or grants.

All this makes an accounting software for fund management and reporting almost mandatory. Pryme Fund Management helps you keep track of your funds or grants regardless of whether they are restricted or unrestricted. Commit, reserve, assign, reassign, allocate and reallocate grants with full traceability and reporting capabilities ensuring that they are used for the specified purposes only.

Monitor how much funding is left on a certain grant or if there’s been overspending with up-to-date reports with the press of a button. Regularly report on your financial performance and use of funds or grants if necessary.

Pryme Fund Management is built on Progressus Advanced Projects, adding fund management, and reporting functionalities to those included in the project accounting software, that’s to say: project set up, quotation, budgeting, resource planning, time keeping, enhanced invoicing and analytics.

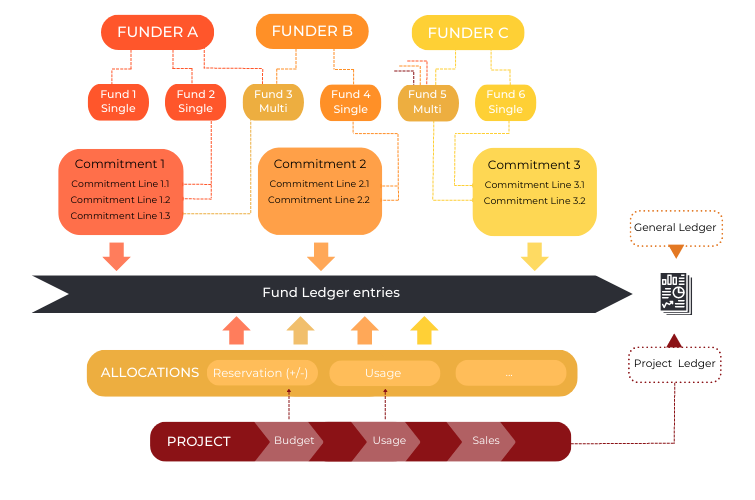

Manage thus the whole grant/fund lifecycle in a Fund Ledger, which is fully integrated with your General Ledger. End-to-end grant management in a unified financial system with reporting capabilities.

The best approach to get started with the Fund Management solution, would be to refer to the following graphical workflow.

The terms used in the image are explained as below:

Watch our YouTube channel for more information about Pryme Fund Management.

Define default settings for the reservation process and no. series.

Managing financial resources, involving commitments and allocations to optimize returns while minimizing risks.

Create reporting data based on financial reports and fund ledger entries.